The Zambia National Advisory Board for Impact Investment (NABII) is a non-profit organisation established in 2019 to accelerate the growth and effectiveness of impact investment Zambia. We are working to mobilize stakeholders and resources to support the creation of a private sector driven “impact economy” which necessitates the integration of measurement of social and environmental impact in all economic activity including government policy, business operations, investor behavior, and consumer consumption. We are a member of the Global Steering Group for Impact Investment (GSG Impact) which was set up to promote and facilitate investment and entrepreneurship with positive environmental and societal impacts across a range of sectors, and build a global network for impact investing.

About Us

Catalysing an Impact Economy

Impact Investment Ecosystem

Impact Investment Ecosystem Pillars

Supply of

Impact Capital

Demand for

Impact Capital

Intermediation of

Impact Capital

Policy and Regulation

Market Enablers

"To the entrepreneur, seeking capital, an investor and a better operating environment, a government is here that understands your challenges and knows exactly what you need in order to thrive."

His Excellency Mr. Hakainde Hichilema

President of the Republic of Zambia

Strategic Objectives

Impact capital transaction value since 2015

Annual capital gross rate

What is Impact Investing?

Why Impact Investing?

What Makes Impact Investing Different

Why is Impact Investment Important in Zambia?

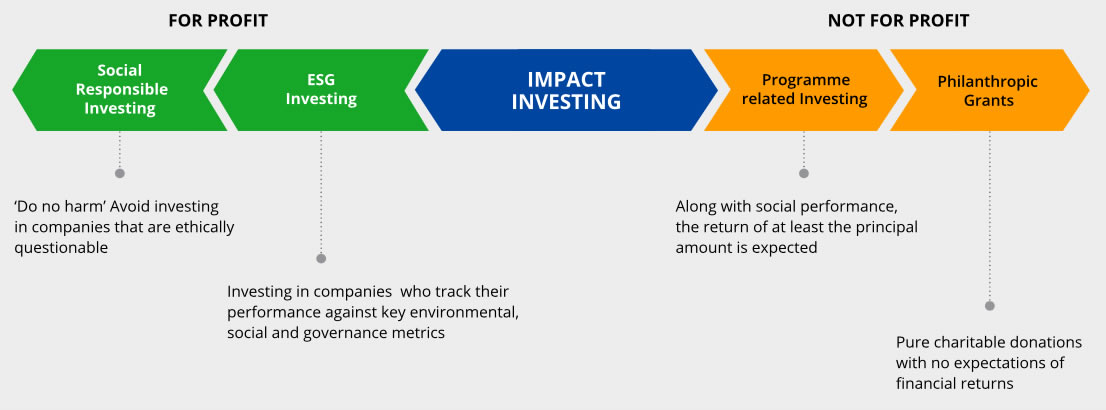

Impact investing challenges the long-held views that social and environmental issues should be addressed only by philanthropic donations, and that market investments should focus exclusively on achieving financial returns. The impact investing market offers diverse and viable opportunities for investors to advance social and environmental solutions through investments that also produce financial returns and is well aligned to the Sustainable Development Goals (SDGs).

Impact investment has the potential to play an increased and significant role in the delivery of Zambia’s development priorities such as driving inclusive economic growth and creation of decent jobs for the low-income and underserved population.

Benefits to Zambia

Improving information among ecosystem players especially businesses on their appropriate capital type and suitable investor types

Accelerating the establishment of angel investor networks and pensions fund participation in impact investment

Improving the institutional capacities of local fund managers and entrepreneurship support organizations

Strengthening the pipeline of impact investment projects

Promoting a more conducive regulatory environment that incentivizes impact investments. This include but not limited to developing regulatory frameworks for crowdfunding platforms and private equity